Olymp Trade مؤشرات التذبذب؟ وهل تتذكر مفهوم حالات التشبع الشرائي والتشبع Olymp Trade هل تتذكر عندما ناقش محلل مرة أخرى، حيث ستساعدك على فهم موضوع اليوم Olymp Trade البيعي؟ إذا كنت لا تتذكر، يُرجى قراءة نصائح فبالإضافة إلى مؤشر القوة النسبية، ومؤشر ستوكاستيك، فقد صُمم مؤشر ديمارك (Demarker olymp trade) أيضًا لمقارنة أحدث الأسعارمع فترات الأسعار السابقة لقياس الطلب على أحد الأصول

يُعد مؤشر ديمارك هو أحد مؤشرات التحليل الفنية قام توماس ديماركر بتطويره. ويتقلب المؤشر في حدود من 0 وحتى 1. ولديه قيمة أساسية تبلغ 0.5، حيث إنه في القاعدة العامة، يُحدد مستوى التشبع الشرائي عند 0.7 ومستوى التشبع البيعي عند 0.3. أما في الإعدادات القياسية، يتم حساب مؤشر ديمارك على 14 فترة، وبالطبع يمكن للمتداولين التعديل إلى أي فترة مُفضّلة. كما يُعد مؤشر الديماركر أحد المذبذبات. فهو يساعد على تحديد اتجاه السعر وقوة الاتجاه. كما يسمح لك المؤشر أيضًا بتحديد الأصول ذات ذروة الشراء والبيع.من الأفضل استخدام مؤشر الديماركر للتداول في انعكاس الاتجاه. يمكن استخدام المؤشر في أي إطار زمني؛ لذلك فهو مناسب لكل من الصفقات قصيرة الأجل وطويلة الأجل.

ويعتبر مؤشر الديماركر بمنزلة وسيلة سهلة لاستخدام المذبذب. حتى أن المتداولين المبتدئين سيكونون قادرين على تعلم كيفية التعامل معها بسرعة.

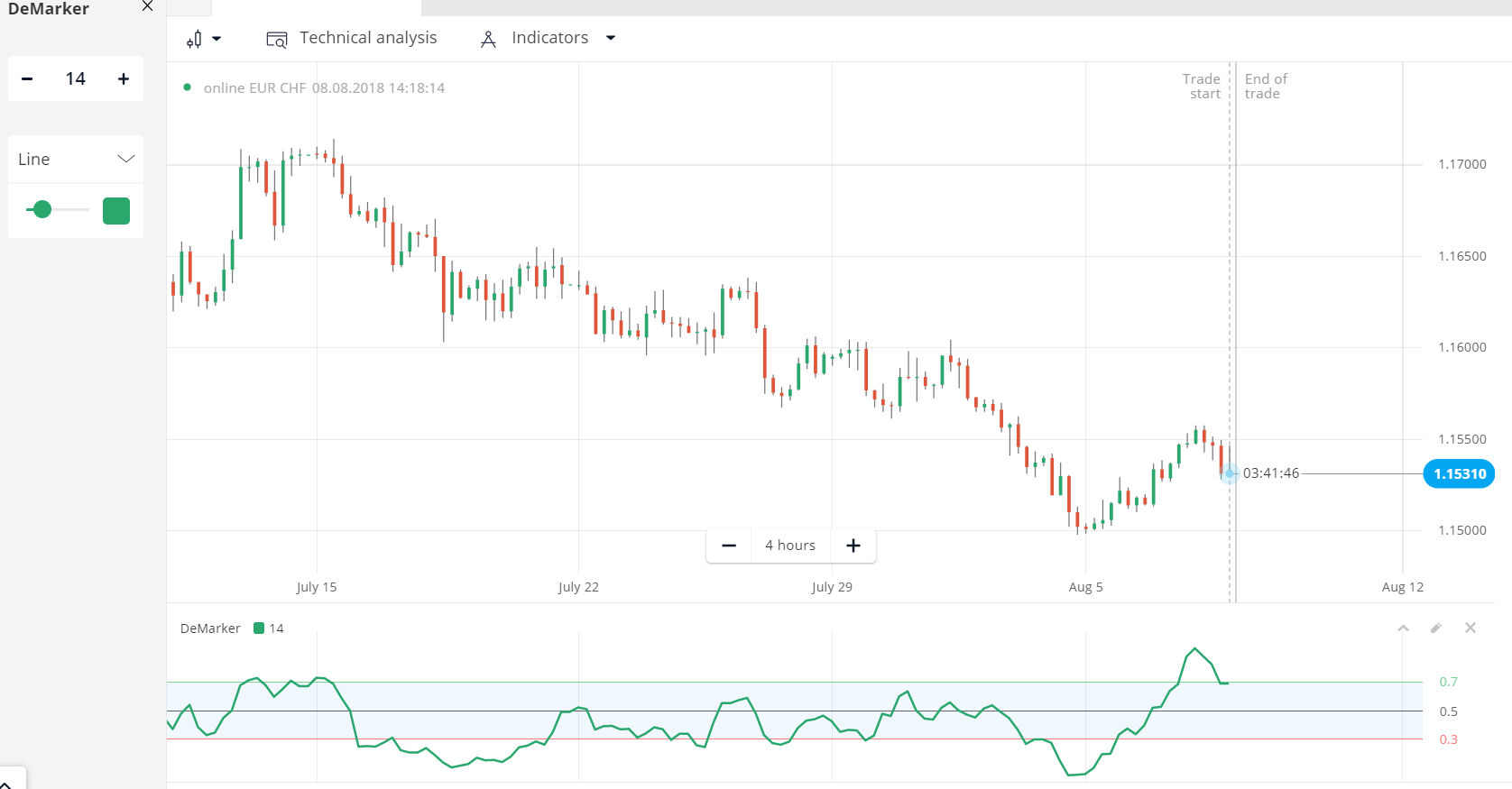

ويُرجى النظر في الصورة التي يُعدّها محللشخصي محترف لشرح المؤشر Olymp Trade

إشارات الأسواق العرضية المتراوحة Oymp trade Demarker

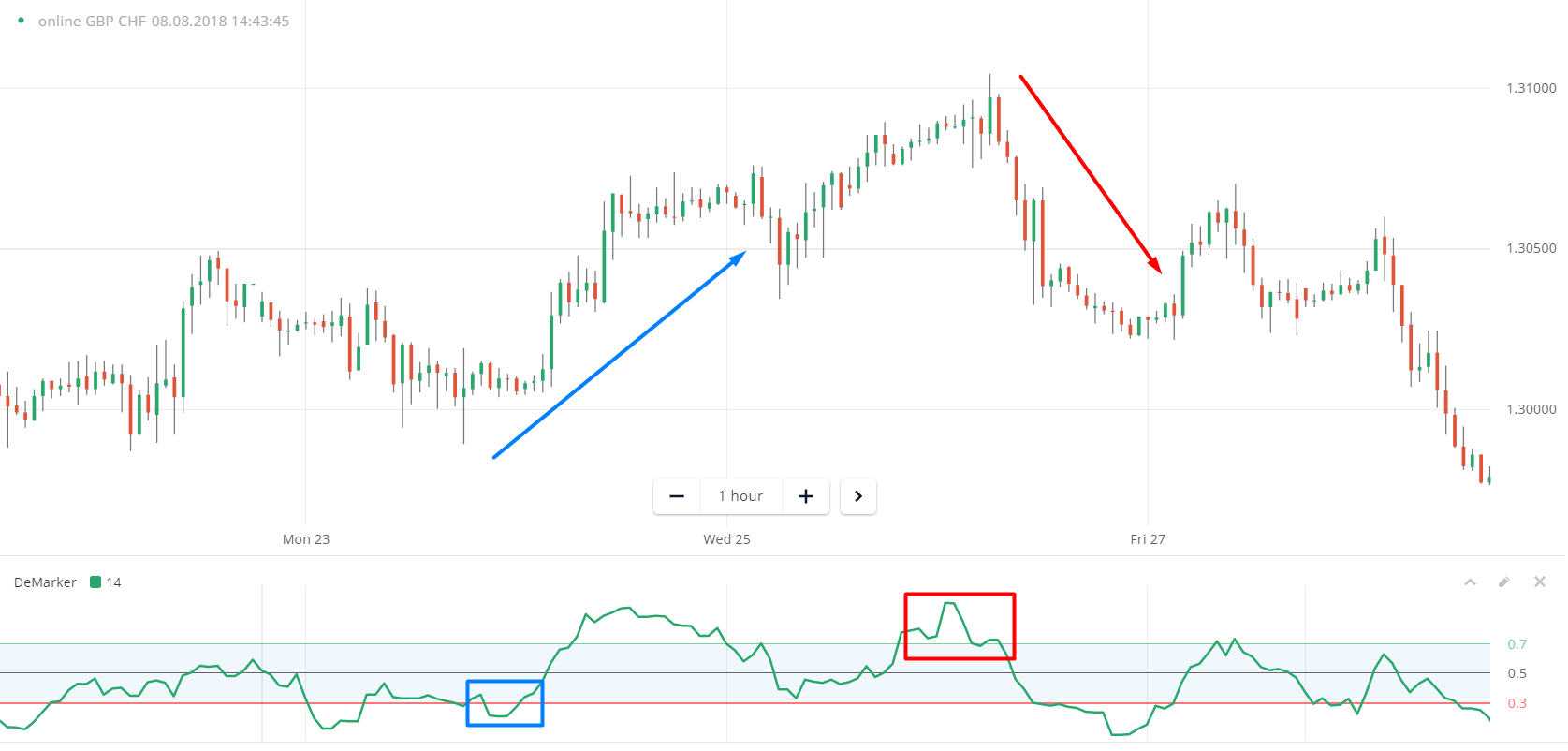

يجب أن يراقب المتداولون متى ينخفض مؤشر ديمارك إلى ما دون مستوى 0.3، ليدخل منطقة التشبع البيعي ويرتفع عنها مرة أخرى، لمنح إحدى فرص الشراء. ومن ناحية أخرى، يجب أن يراقب المتداولون مراكز البيع عندما يرتفع مؤشر ديمارك فوق مستوى 0.7 في منطقة التشبع الشرائي وانخفاضه إلى ما دون ذلك مرة أخرى، ما يدل على إمكانية بدء لك لشرح إشارات حالات التشبع Olymp Trade الاتجاه الهابط. يُرجى إلقاء نظرة على الصورة التالية التي يعدها محلل البيعي والتشبع الشرائي

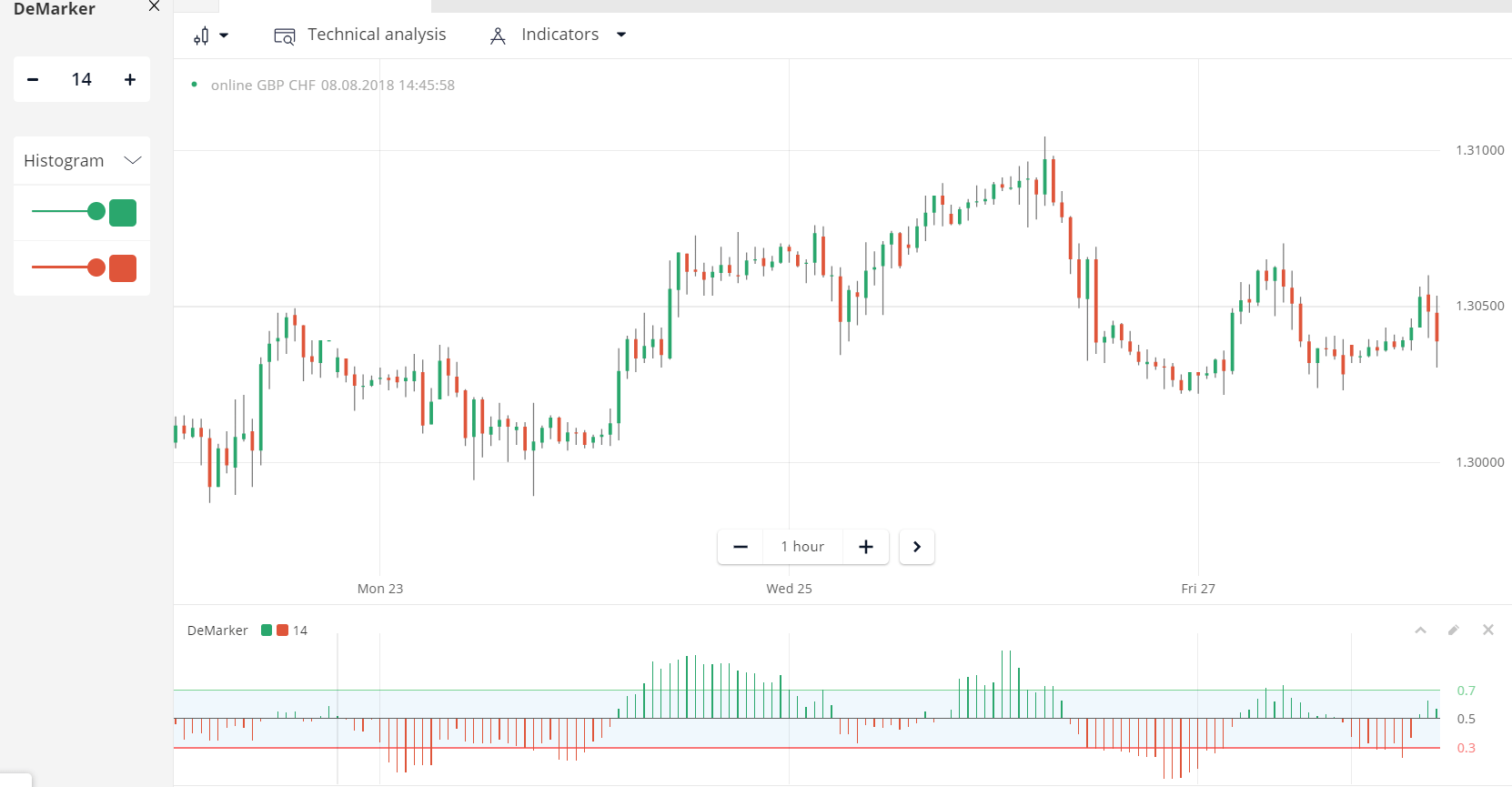

من الممكن أيضًا أن تُحدد مؤشر ديمارك في أسلوب المدرج التكراري إذا كنت تفضل ذلك. كما أنه من الأسهل تحديد ،قوة حركة السعر وتراجع اتجاهه المحتمل. وعندما تكون الأعمدة خضراء، يُظهر مؤشر ديمارك اتجاهًا صاعدًا. وبالتالي عندما تكون الأعمدة حمراء، فإن المؤشر يمثل حركة هبوطية. انظر إلى الصورة التالية التي توضح كيفية تغيير إعدادات مؤشر ديمارك

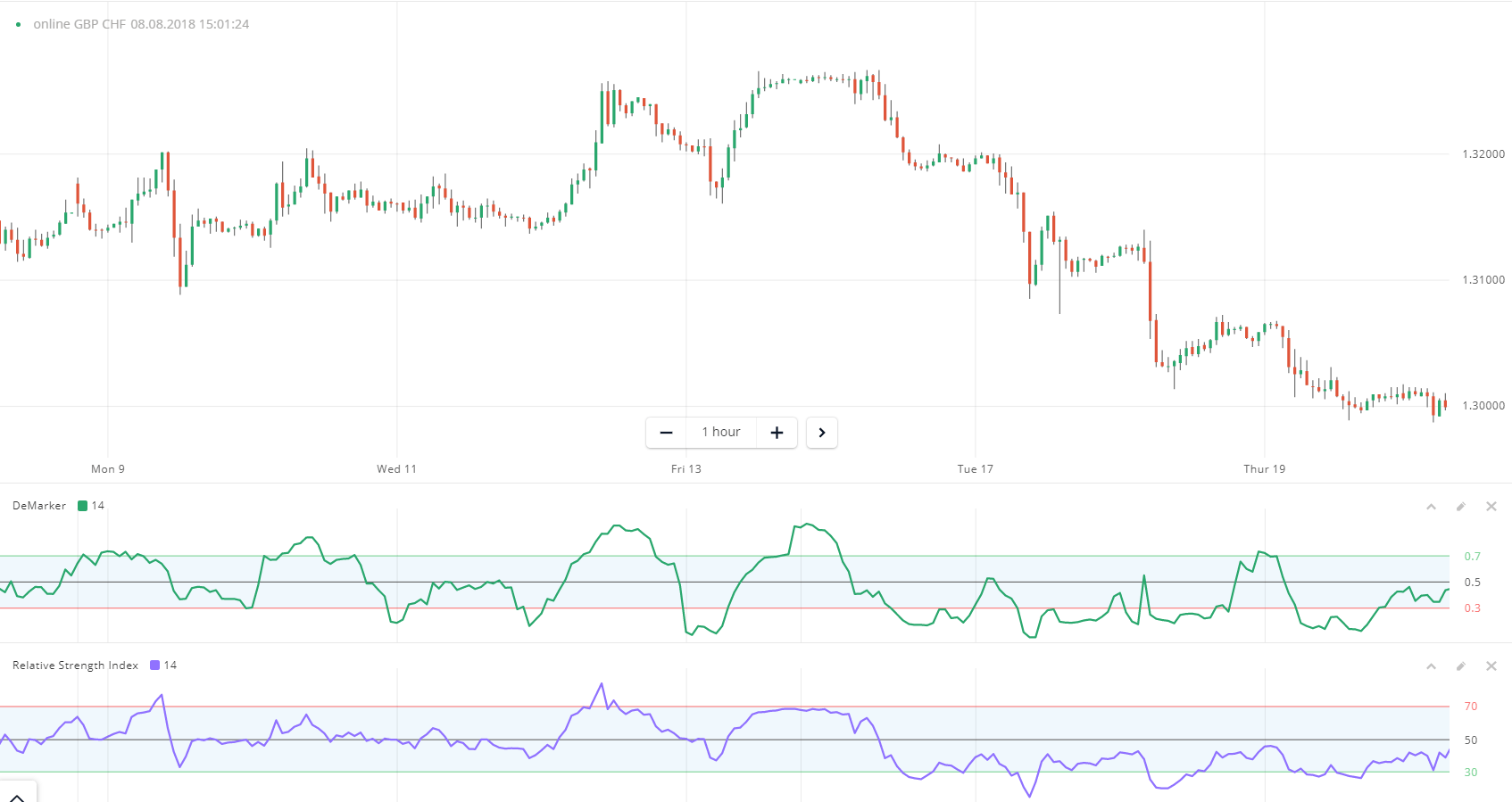

يعرفون أيضًا أنه يمكن استخدامه لمقارنة Olymp Trade بما أن مؤشر ديمارك يُعد أحد المتذبذبات، فإن محللي الإشارات مع متذبذب مختلف، مثل مؤشر القوة النسبية (RSI). ويمكنك التحقق من كل من مؤشر ديمارك ومؤشر القوة النسبية Olymp Trade على الرسم البياني الموجود أسفل الصورة التي أعدها محلل(RSI)

من الممكن تصور أن كلا الخطين متماثلين تقريبًا. والفرق الرئيسي بينهما هو أن مؤشر ديمارك يتحرك بشكل أسرع، مما يعطي المزيد من الإشارات في مناطق التشبع البيعي أو مناطق التشبع الشرائي. ولكن كن حذرًا، حيث لا تعني الكمية في الإشارات دائمًا ضمان جودة نقاط دخول التداول. حيث يعتمد استخدام المؤشرين ديمارك أو مؤشر القوة النسبية على أي نوع من المتداولين أنت لميل نحو التداول العدواني أو المحافظ اهتمامًا إلى حقيقة أن مؤشر ديمارك يُحذر من ،Olymp Trade يُولي العديد من المتداولين، بما في ذلك محلل احتمال حدوث تراجع عند مناطق التشبع البيعي والتشبع الشرائي، ويجب تضمين هذا في نظام التداول الخاص بك. نتمنى لك

كيف تتداول مع Demarker على منصة Olymp Trade

في أوقات السوق ، يتحرك مذبذب DeM حول قيمة 0.5. لا يوجد اتجاه قوي ومن الأفضل مراقبة السوق والانتظار. يجب عليك اتخاذ إجراء عندما تتقلب DeM إلى ما وراء قيم 0.3 أو 0.7.EURUSD 1 مخطط دقيق مع مؤشر DeMarker

إذن كيف تتداول؟ حسنًا ، هناك العديد من الطرق و الأساليب. يمكنك الدخول في صفقة شراء عندما يقترب خط المؤشر من قيمة 0.7. يمكنك أيضًا فتح مركز قصير بمجرد أن يتجاوز DeM المستوى 0.7 لأنه يعني أن الاتجاه الهبوطي قادم. عندما يقترب المذبذب من قيمة 0.3 ، فهذه إشارة لوضع مركز بيع. ولكن عندما يتجاوز 0.3 ، فإن الاتجاه الصعودي قادم ، وبالتالي ، يجب عليك الدخول في صفقة شراء. هذه طريقة بسيطة لتحديد اتجاه الاتجاه القادم والتداول معه. إذا كانت إشارات DeM تشير إلى الاتجاه الصعودي ، فإنك تضع مركزًا طويلًا. إذا كان يشير إلى أن الاتجاه الهبوطي في طريقه ، فأدخل موضع قصير.

كيفية تداول المراكز طويلة الأمد باستخدام مذبذب Demarker

3 تداولات 5 دقيقة ناجحة مأخوذة من مخطط 1 دقيقة مع DeMarker

ألقِ نظرة على الرسم البياني المثالي أعلاه. يُظهر 3 تداولات رابحة متتالية على أساس إشارات مؤشر DeM. في الحالة الأولى ، كان مؤشر DeMarker يتأرجح تحت قيمة 0.3. ثم تجاوز 0.3 وتحرك للأمام 0.5. كانت إشارة للاتجاه الصعودي القادم ولهذا دخلت في صفقة شراء مدتها 5 دقائق. الوضع الثاني هو العكس. تجاوز DeM قيمة 0.7 وبعد فترة من الوقت قطعها واستمر نحو 0.5. كان الاتجاه الهبوطي قادمًا لذا دخلت في مركز بيع والمركز الثالث مشابه للموقف الأول. كان DeM يعبر 0.3 من الأسفل لذا فتحت مركز شراء.

الآن لديك نظرة عامة على مؤشر DeMarker ، انتقل إلى حسابك التجريبي في Olymp Trade وتحقق من كيفية عمله. اترك تعليق على التقدم المحرز الخاص بك

أداة واحدة ك Demarker olymp trade لا تصنع صندوق أدوات

في حين أن DeMarker Oscillator أداة قيمة ، إلا أنها ليست مثالية. من الأفضل استخدامه مع أدوات أخرى مثل RSI و CCI و Williams٪ وغيرها من الأدوات عند اتخاذ قرارات التداول. ينصح بشدة تعلم كيفية دمجها في استراتيجية.

بالطبع ، لا توجد استراتيجية أو أداة “أفضل” ، ولكن باستخدام DeMark Oscillator كجزء من استراتيجيات مثل Fibonacci Pivot Points و Camarilla Pivot Points و DeMark Analysis ، يمكن للمتداولين تقليل مخاطر الخسارة مع تحسين توقيت السوق..

و يعد مؤشر ديماركر احد اهم و افضل المؤشرات و الادوات التداولية التي من الممكن استعمالها للتداول على منصة olymp trade كما يعد جد ممتاز من عدة نواحي خاصة التواحي الخاصة بالتحليل الفني و كوسيلة مساعدة و رائعة جدا في التداول لهذا فنحن ننصح باستعماله و التعلم في هذا المؤشر لاميته الكبيرة جدا و كونه مربح جدا للمتداولين المحترفين و المبتدئين على حد سواءا لمن يريد مزيد من هته المقالات حول المؤشرات و المذبذبات و الامور الخاصة بالتداول فيمكن اخبارنا في التعليقات و سنكون جد سعداء باستقبال تعليقاتك و ارائكم حول هذا المقال و كذلك اقتراحاتكم من اجل معرفة المقالات المفضلة بالنسبة لكم و توفيرها من اجلكم كما نتمنى من

الكل ان يقوم بتجربة مؤشر ديماركر DeMark Oscillator على منصة olymp trade حيث انها مهمة جدا و قد ننفعكم كثيرتا في مسيرة التداول الخاصة بكم

حظا سعيدا و نتمنى لكم فائق النجاح و التفوق على منصة olymp trade (DeMarker)تداولًا ناجحًا مع مؤشر ديمارك

صحيح أن عليك أن تكون حذرا للغاية عند التداول مع ديماركر في الأسواق ذات الاتجاه. أنا أطبق هذا المؤشر على استراتيجيات olymp trade فوركس خاصتي عندما أرى أن السعر يتحرك أفقياً ضمن نطاق لفترة من الوقت. بمجرد أن أرى أن الاتجاه قد بدأ، أزيل هذا المؤشر. في السوق ذي الاتجاه، سيعطيك الكثير من إشارات الانعكاس الخاطئة عند كل قمة أو قاع.

ديماركر لا يستحق اهتمامك. إذا لم أكن أتداول مع Olymp Trade منذ فترة طويلة، لقلت أن Olymp Trade نصابين وتقدم مؤشرات لا تعمل. وهذا طبعاً ليس صحيحًا، المؤشر الوحيد السيئ هو ديماركر، فقط تجنبه وكل شيء سيكون على ما يرام.

إذا لم تكن قد اكتشفت ذلك تمامًا، فلا تأخذ خطوة بعد. ليس من أجل لا شيء أن Olymp Trade تشير باستمرار إلى مقالات سابقة. إن ذلك ضروري لضمان قيام المتداولين بإعادة قراءة المعلومات باستمرار، واستنادًا إلى الخبرة الشخصية، يمكنهم الحصول على فكرة عن السوق وقوانينه.

تستند العديد من الاستراتيجيات على هذا. وهذا صحيح، لأنه كما تقول مراجعات olymp Trade في كثير من الأحيان، فإن المفاهيم الأساسية هي التي تساعد على فهم الاستراتيجيات مهما كانت معقدة في المستقبل.

بصراحة. ديماركر سهل في التطبيق وليس الفهم. لقد شاهدت ندوة Olymp Trade عن مذبذب ديماركر وفهمت بسهولة كيفية التداول به، ولكن ما زلت لا أفهم كيف يتم بناؤه. لقد قرأت حتى بعض المقالات الفنية بالإنجليزية حول هذا المؤشر، لكنني ما زلت لا أفهم. بالمناسبة، هذا لا يهم، لأن المهم هو أن أفهم كيفية استخدامه وكيفية الربح منه.

هل هناك أي طريقة لتغيير إعدادات منصة تداول Olymp Trade؟

منصة التداولنعم عزيزي كاموس يمكنك تغير الإعدادات كما تشاء لمزيد من المعلومات تعرف أكثر علي منصة التداول Olymp Trade

اتمنى لك حظاً طيباً

ما مدى موثوقية مؤشر ديماركر؟

olymp trade مرحباً عزيزي لمعرفة المزيد عن المؤشرات والمذبذبات

يمكن أن يكون أي مؤشر مفيد.

الشيء الرئيسي هو فهم الإعدادات والأطر الزمنية وتطبيقها بشكل صحيح.

يمكنك ضبط العديد من الأشياء، بما في ذلك الإطار الزمني والمؤشرات. تم تصميم منصة Olymp Trade لتكون الأفضل للمبتدئين، لذلك لا أعتقد أن هناك فائدة من تخصيص منصة Olymp Trade.

أعتقد أنها فكرة جيدة أن تشارك olymp Trade فوركس بعض النصائح المفيدة وهي بالتأكيد بمثابة تأكيد آخر على أن هذه الشركة تهتم بعملائها وتفعل كل ما هو ممكن حتى يتمكن الأشخاص من العمل هنا دون مشاكل ومخاوف، ويمكنهم العمل أفضل مع الخدمات وفرص السوق، وكسب المزيد وبالتالي ضمان سمعة طيبة لشركة الوساطة.

هل لاحظت أن هذا واضح حتى في الأشياء الصغيرة؟

لنأخذ الحساب التجريبي كمثال. يمكنك استخدامه هنا في أي وقت تريده. وهذا على الرغم من أن الحساب التجريبي يحتوي على معظم ميزات المنصة الرئيسية. ماذا يفعل؟ القدرة على التعرف على المنصة الرئيسية، وتعلم كيفية العمل مع المستويات والمؤشرات المختلفة، وفهم كيفية ضبط الإعدادات – كل هذا ينعكس بشكل مباشر على جودة المتداول.

علاوة على ذلك، يلفت نظري الآلية المبسطة للرافعة المالية. يبدو أن هذه أشياء تافهة، ولكنها تساعد أيضًا المتداول (خاصةً الذي بدأ للتو في العمل) على التعامل مع الحسابات بشكل أسرع، وتحديد الهامش المتاح الضروري وغير ذلك الكثير. وبالمناسبة، يتراوح نطاق الرافعة المالية هنا من 1:50 إلى 1:500 – أي أن هناك فرص جيدة، لكن الشركة لا تزيد من المخاطر، وهو أمر مهم بشكل خاص نظرًا لأن olymp trade تتيح العمل ب 10 دولارات فقط.

وأنا أتحدث فقط عن الأشياء الأساسية، دون الأخذ في الاعتبار أن هناك مميزات دقيقة أكثر ولكنها مفيدة، والتي يتم استخدامها أيضًا بنشاط من جميع المتداولين في الشركة.

لا أحب استخدام المؤشرات، أفضل تداول الأخبار. في الواقع، يكون التداول الفني باستخدام المؤشرات أفضل عندما يكون السوق مستقرًا ولا يتم التحكم في تقلباته إلا من قبل المتداولين في السوق. ولكن عندما يتأثر السوق بعوامل خارجية، على سبيل المثال الأخبار غير المتوقعة، فمن المرجح أن تخسر المال أكثر من المتداولين في الأخبار. هذه اللحظات هي الفترة الذهبية لمن يتداولون الأخبار. يعد Olymp Trade مفيدًا لكلا الأسلوبين في التداول، لكنني أفضل التداول على الأخبار، مما يجعلني أشعر براحة أكبر.

يعتبر مؤشر ديماركر فعالاً للغاية عندما ينوي المتداول تحسين نسبة الصفقات الرابحة والخاسرة. الميزة الرئيسية لمثل هذا المؤشر هي القدرة على تحديد حركة الاتجاه أو تغييرها.

يعتبر المؤشر نفسه وسيلة لاكتشاف التقييم غير الصحيح لأداة التداول في السوق، في حين أنه لا يحتوي على العديد من الجوانب السلبية الموجودة في مؤشرات التذبذب الاعتيادية. يحدد مؤشر ديماركر الحدود القصوى المحتملة للسوق. يعجبني أن هناك العديد من المؤشرات المتاحة لعملاء الوسيط في التداول على Olymp Trade فوركس مجانًا

أتداول بنشاط مع Olymp Trade، لكنني لست بحاجة إلى ديماركر. أعتقد أن ستوكاستيك هو المذبذب رقم واحد الذي يحتوي على إعدادات مرنة يمكن تكييفها بسهولة مع أي استراتيجية. لا أرى أي شيء مميز في ديماركر بعد هذه المراجعة. أعتقد أنه يمكن استبداله بأي مذبذب، مثل RSI، أو ستوكاستيك، إلخ.

في تداولي، أولي المزيد من الاهتمام للقنوات العلوية والسفلية. عندما يرتد السعر من أي منها، فهذه إشارة أقوى بكثير بالنسبة لي من أي دليل من المذبذب. إلى جانب ذلك، غالبًا ما تتأخر مؤشرات التذبذب في تقديم أدلة أو تضلل المتداولين.

ومع ذلك، قد أغير رأيي بمجرد اختبار ديماركر على حساب تجريبي.

دائمًا ما تدهشني المراجعات من Olymp Trade فوركس ببعض التفاصيل الحديثة – يتم شرح كل شيء بلغة بسيطة ومفهومة ومن المستبعد الحيرة هنا، لأن كل شيء موجه حتى يتمكن المتداول من أي خبرة من فهم المعلومات التي يراها.

في Olymp Trade فوركس، يمكنك دائمًا اكتساب معرفة جديدة، وبفضل ذلك، النظر إلى الموقف من جانب غير متوقع تمامًا. بالنسبة لي، هذا مهم بالطبع، لأنه يؤدي إلى حقيقة أنك تتصرف بشكل أكثر كفاءة ودقة ويمكنك دائمًا اتخاذ القرارات الأكثر استنارة التي تجلب لك الربح. بالطبع تدعم Olymp Trade فوركس المتداولين من الجانب المالي، هنا يمكنك البدء في العمل بمبلغ 10$ واستخدام البونص دون القلق بشأن سحب الأموال.

ما يجذبني هو أن olymp trade لا تسمح لي بتفويت أي أدوات ومؤشرات واستراتيجيات مهمة في السوق. وحتى إن لم تستخدمها في الممارسة العملية، فسيكون لها تأثير إيجابي على نتائجك على أي حال وهي بمثابة نوع من العملية التعليمية التي تتطور بشكل غير متوقع من أجلك. ربما يكون الشيء الرئيسي هو تجربة تنسيقات مختلفة للعثور على ما يساعدك حقًا في عملك. لأن كل متداول هو شخص مختلف وقد يرى كل شخص نفس البيانات أو الأدوات بشكل مختلف. لذلك لا يجب أن تساوي الجميع ببعضهم البعض. لكل شخص الحق في اتخاذ قرارات شخصية وخطة عمل شخصية توفر اليقين بشأن ما هو قادم.

بالنسبة للمحترفين، يمكنني القول أن هذه المنصة أنيقة – أعني أنها مريحة، مع تصميم سهل الاستخدام وكل ما تحتاجه للتداول.

أعتقد أن معدلات العائد على الصفقات مرتفعة أيضًا – كما تعلم، أشاهد أحيانًا مراجعات للوسطاء الآخرين ولم أر أبدًا معدلات أعلى منها بشكل ملحوظ. بشكل عام، معدلات الشركات المنافسة إما أقل أو متشابهة تقريبًا.

إلى جانب ذلك، أحببت التدريب. كان حضور الندوات من البداية أمر رائع. لقد تعلمت الكثير من المواد المفيدة. لا أستطيع حتى أن أتخيل مقدار المال الذي كان بإمكاني أن أنفقه بحماقة في البداية لو لم تعلمني تلك الندوات أساسيات التداول 🙂

بالنسبة إلى السلبيات، أود أن أشير إلى أنه يتعين عليك سحب الأموال بنفس طريقة الإيداع السابقة. كما ترى، أودعت بمحفظة إلكترونية، لأنني لم أكن أعرف مكان التقدم للحصول على هذه الأموال على أي حال.

في الوقت نفسه، كنت أريد سحب الأموال مباشرة إلى بطاقة الائتمان، لكن هذه ليست الطريقة التي يعملون بها. لذا الآن، سأضطر إلى إيداع مبلغ صغير آخر، هذه المرة ببطاقة الائتمان الخاصة بي. ليس موضوع كبير. لا يوجد عمولات على هذا. فقط… بعض التعب، كما نعرف.

بصراحة، لم أستخدم مؤشر ديماركر حتى الآن. بالنسبة لي، لا تزال مؤشرات التذبذب غير مفهومة، لكنني أتعلم وسأعرف كل شيء. أتداول مع Olymp Trade فوركس وأريد أن يكون هذا عمل حياتي.

تم إنشاء المذبذب الذي تتكلم عنه هذه المراجعة بواسطة متداول ممارس ومستثمر ومحلل ناجح توماس ديماركر. كان الغرض من إنشائه هو رغبة المؤلف في ابتكار مثل هذه الأداة، والتي من شأن استخدامها أن توفر أقصى قدر من المساعدة للمتداول في عملية التداول، وحمايته من الإشارات الخاطئة.

ديماركر هو أحد مؤشرات التذبذب المتاحة على منصة Olymp Trade. مثل المؤشرات الأخرى، فإنه يحدد مناطق ذروة البيع والشراء في السوق.

1) تقدم Olymp Trade فوركس، كما هو الحال دائمًا، شرح متعمق حول استراتيجيات التداول المختلفة بناءً على المؤشرات الفنية. بعد قراءة المواد التعليمية ومشاهدة دروس الفيديو التي يقدمها الوسيط، تعلمت الكثير حول كيفية تطبيق التحليل الفني في بحثي اليومي في سوق الفوركس. إنه يساعد بالفعل في فهم معنويات السوق الحالية لوضع توقعات دقيقة وإيجاد نقاط دخول مربحة.

2) مذبذب ديماركر هو أداة قوية لتحديد الانعكاسات أثناء التحركات الجانبية. يعكس المؤشر تمامًا التأرجحات الصاعدة والهابطة عندما لا يكون هناك اتجاه واضح. لديه حساسية مرنة حسب الإعدادات. يمكن أيضًا توسيع النطاق بين مستويات ذروة الشراء وذروة البيع لخفض عدد الإشارات على إطار زمني محدد.

3) ومع ذلك، فإنني أفضل استخدام المذبذبات مع أنواع أخرى من المؤشرات: ماكدي وأدكس والمتوسطات المتحركة وسحابة إيشيموكو. يعد ذلك مفيد في الأسواق ذات الاتجاه للتنبؤ بعمق التصحيح المحتمل واستخدام نهج التداول على الانعكاس.

مؤشر ديماركر أحد الأدوات في مجموعتي من الأدوات الفنية. أنا أحب المذبذبات لأنها تمثل نطاق السوق، وتشير إلى مستويات ذروة البيع والشراء. إلى جانب ذلك، فهي مفيدة في:

– تستخدم مع المؤشرات الأخرى؛

– ايجاد الاختلافات.

– إظهار نقاط الانعكاس؛.

من المفيد جدًا للمتداولين المهتمين بالتداول على المدى القصير تجربة مجموعات مختلفة من مؤشرات التذبذب مثل RSI وديماركر. يجعلهم أكثر مرونة. يعرف محللو Olymp Trade ما يفعلون.

A very useful article for me The Demarker indicator is one of the most important indicators that I always use in trading

أنا أيضا أعتبر أنه من المهم قراءة مقالات من olymp trade forex، لأنها تهدف دائمًا إلى ضمان أنه يمكنك الحصول على البيانات الضرورية التي يمكن استخدامها لتحليل السوق أو للتداول المباشر.

العامل الرئيسي الذي يميز هذا عن الباقي دائمًا هو أنه مكتوب بحيث لا يكون مجرد حركة إعلانية من شركة أو بريد عشوائي آخر – فهو مكتوب حتى يتمكن الأشخاص من تلقي معلومات مفيدة ويمكنهم دائمًا استخدامها في السوق لذلك يكون كل شيء في محله – يعني، إلى أقصى حد ممكن.

قد يبدو الأمر فلسفي إلى حد ما، لكنه حقًا كذلك – في أي عمل نقدر حقيقة أن لدينا فرص جديدة.

التطبيق جيد لكن انا عندي سؤال ما هو الحد الاقصى للسحب يعني اكبر مبلغ ممكن اسحبه من التطبيق؟

اكبر مبلغ ممكن سحبه في كل مرة هو 15000 دولار او يورو حسب عملة حسابك و لو كنت تريد سحب مبلغ اكبر من هذا فانه يجب ان تقوم بهذا على دفعات

هذا مؤشر شائع للغاية يستخدمه المتداولون من جميع أنحاء العالم على نطاق واسع وكان محللو olymp trade على كل حق عندما قرروا كتابة مقال حول هذا المؤشر. ومع ذلك، يجب أن أشير إلى حقيقة أن المؤشرات يجب أن تستخدم فقط مع المؤشرات الأخرى من أجل التأكد من الإشارات التي تقدمها.

يمكنني القول بصراحة أنني أجد صعوبة في تقييم Olymp Trade – لأنها تجربتي الأولى وليس لدي بالتأكيد ما أقارنه بها.

من ناحية أخرى، أستطيع أن أقول من موقع شخص ليس لديه خبرة عملية – مقالاتهم وتوصياتهم مكتوبة للناس، بكلمات واضحة وبدون الكثير من المصطلحات، حتى تحصل على الجوهر ويمكن أن تبدأ العمل .

ما زلت متداول تجريبي ولا يمكنني اتخاذ قرار بشأن العمل بنشاط حتى الآن، لكنني أعتقد أنه سينجح.

أستخدم ديماركر طوال الوقت أثناء تحليل السوق وأحب ذلك كثيرًا.

كانت تلك في الواقع olymp trade التي لفتت انتباهي إلى هذا المؤشر وأنا ممتن جدًا لها. أعني أنني صادفتها في قائمة المؤشرات في منصة التداول وأصبحت مهتم جدا بتعلمها. أدركت لاحقًا أنه مؤشر موثوق ودقيق للغاية وسهل الاستخدام. بالطبع، لا أستخدمه بمفرده وأدمجه مع مؤشرين آخرين، لكن ديماركر لا يزال جزء مهم من اتخاذ القرارات.

على أي حال، أعتقد أنه من الأفضل للمتداول أن يتعلم كيفية استخدام جميع المؤشرات المتاحة على المنصة. كلما زادت المعرفة لديك، كانت الصورة أدق للسوق الحالي لديك، والتي ستجعل أرباحك تنمو بالتأكيد، إذا كانت نفسيتك على ما يرام.

سمعت عن مذبذب ديماركر، ومع ذلك لم أستخدمه أبدا. أود أن أشكر محللي olymp trade على أنهم شرحوا جميع التفاصيل حول التداول باستخدام مذبذب ديماركر في هذه المقالة.

في رأيي، يجب أن يكون المتداولون متغيرين ومرنين من أجل استخدام مؤشرات وأنماط مختلفة في التحليل الفني، لأنه إذا كنت ستستخدم واحد أو اثنين فقط، فربما لن تنجح.

توصيات Olymp Trade تعمل.

يمكن لأي شخص أن يجد شيء مناسب ليه.

أعترف بصدق أنني لا أستخدم تقييمات الفوركس الخاصة بـ Olymp Trade بشكل مباشر.

هذا يرجع في الغالب إلى حقيقة أنني أمتلك بالفعل الكثير من الخبرة والنهج الخاص بي الذي يناسبني كما أنني قرأت أيضًا الموارد التحليلية التي تصف جميع أحداث السوق بمزيد من التفصيل.

على أي حال، أود أن أشير إلى أنني بدأت بهذه المراجعات لـ Olymp Trade وواصلت العمل في السوق بجدية، لأنها كتبت بطريقة يفهم الناس حقًا ما يقولونه ويمكن أن تشكل قاعدة منطقية من الممكن أن تؤدي إلى القرار النهائي.

صدقني، إنها ليست مهمة سهلة، خاصة بالنظر إلى عدد المبتدئين الذين يعملون هنا.

مذبذب ديماركر مفيد جدًا، لكنني توصلت مؤخرًا إلى استنتاج مفاده أن جميع مؤشرات التذبذب هذه ليست مفيدة. قد تساعدك على تحديد اتجاه السعر، لكن نادرًا ما يحدث ذلك. تقدم Olymp Trade العديد من الأشياء الأخرى لإجراء التحليل، على سبيل المثال، التقويم الاقتصادي. من الأفضل التوجه نحوه، بدلاً من التركيز على المؤشرات …

لا يوجد اي احتيال في Olymp Trade لا داعي للقلق خالص

على الرغم من المقالة المنشورة منذ فترة طويلة – لا يزال بإمكانك العثور على بعض الكلمات الحكيمة هنا. شكرًا!

أنا شخصياً لا أرى فائدة كبيرة في استخدام مؤشر ديماركر في تداولاتي. أفضل استخدام مؤشر القوة النسبية. لكن من الجيد أن يكون المتداولين تحت تصرفهم، في منصة Olymp Trade، كتنوع.

أحب olymptrade لأنها تحتوي على كل ما تحتاجه للتداول. بما في ذلك الأشياء التي تمت مناقشتها في تلك المقالة.

أثق في نصيحة Olymp Trade.

لأنهم ينجحون.

لأنهم منطقيون.

خاصة إذا كنت تستمع إليهم، وإذا كنت تريد أن تصبح متداول رابح بنفسك.

فهم يفهمون ما قد لا نفهمه ويحاولون تفسيره.

عندما اخترت Olymp Trade، كنت بالطبع أبحث على وجه التحديد في الوظائف التي تقدمها والأصول التي يمكنك استخدامها هنا.

عامة، كنت سعيد بما رأيته، لأن لديهم قاعدة فنية جيدة حتى تتمكن من تحليل السوق للصفقات وفتح الأوامر في أي وقت.

ولكن عمليًا، لاحظت بعض الميزات الأخرى التي أحبها وأستمر في استخدامها.

1. بالطبع إنه نظام البونص، إنها المرة الأولى التي أجد فيها وسيط يعطي بونص ولا يطلب منك سحب أموالك من حساب التداول الخاص بك في المقابل. هنا يمكنك القيام بأي شيء تريده وحتى إذا قمت بتغيير خططك، يمكنك السحب من حساب التداول الخاص بك، حتى لو قمت بالإيداع اليوم فقط وأخذت البونص اليوم فقط.

2. يمكن أن يكون الحساب التجريبي مفيد في أي مرحلة، وصحيح أن Olymp Trade لا تحظرك، حتى لو كنت تتداول هنا لفترة من الوقت، فإنه يسمح لك بتعلم وتجربة شيء ما دون خسارة أي أموال حقيقية.

ساعدني Fixed-time trading مع هذا الوسيط على العودة إلى تداول السوق الراكد. في وقت سابق، استهنت بالأطر الزمنية الأصغر مثل 5 ق- 15 ق. الآن هم المفضلون لدي لأنهم يناسبون fit fixed-time trading بشكل مثالي.

أستخدم مؤشر ديماركر، جنبًا إلى جنب مع مؤشرات الاتجاه الأخرى لـ olymp trade على وضع تداول الفوركس. أعتقد أنه يناسب أفضل بهذه الطريقة. بالنسبة لـ fixed trading، أميل إلى استخدام خطوط مختلفة: الدعم/المقاومة، خطوط الاتجاه، المتوسط المتحرك، التمساح، إلخ.

من الجميل أن يكون لديك خيار من بين جميع أدوات olymp trade هذه التي يمكن أن تعزز تداولك وربما تزيد من أرباحك.

Olymp وسيط رائع يهتم بنجاح عملائه. شروط التداول جيدة حتى مع حساب 1 دولار.

يمكن للمذبذبات أن تقدم مؤشرات قيمة، خاصة عندما يتعلق الأمر بأطر زمنية أطول. يمكن أن تظهر لك نقاط تحول الاتجاهات القوية. ولكن تذكر أن الاعتماد الأعمى عليها خلال اليوم وعلى المدى القصير يمكن أن يكون مضلل جدا، لأنه خلال اليوم، تعيد البنوك وصناديق التحوط تخصيص رأس مالها، وبالتالي تخلق الكثير من الضوضاء الخادعة في المؤشر، وتعد مؤشرات التذبذب مؤشرات حساسة جدا لهذا الموقف. حاول التركيز على الأطر الزمنية اليومية والأسبوعية، حتى يتمكن مؤشر ديماركر من إعطاء إشارات أكثر موثوقية لك، إذا تم تأكيد الإشارة من خلال حركة السعر.

مؤشر ديماركر قريب جدًا من مؤشر ستوكاستيك بطبيعته. أعتقد أن الفرق الرئيسي هو أنه يمكن أن يعطي إشارة أسرع قليلا. وأنا أتفق مع الكاتب حول ضرورة الجمع بينه وبين مؤشر آخر. يمكن أن يكون مؤشر القوة النسبية أفضل خيار بهذه الطريقة.

أثناء التداول، يعد مؤشر القوة النسبية أحد أكثر المؤشرات استخدامًا لمراقبة الصفقات. هذا مهم بالنسبة لي لأنه يساعدني على معرفة وتحديد إمكانات الصفقة وما إذا كان التراجع يقترب.

يعد ديماركر مؤشر من وجهة نظري، مشابه لمؤشر القوة النسبية ولكن بتمثيل مختلف. يستخدم RSI رسم بياني خطي بينما يستخدم ديماركر مخطط. عادة ما تكون صفقات تشبع الشراء أو تشبع البيع صفقات محفوفة بالمخاطر لأن الانعكاس يمكن أن يحدث في أي وقت. من المستحسن استخدام هذه المؤشرات جانب المؤشرات الأخرى لتوفير المزيد من المعلومات حول الصفقة. بحق، جعلت Olymp Trade التداول سهل جدًا حيث يمكن الوصول إلى جميع المؤشرات وتعلمها بسهولة.

هذا مثير للاهتمام حقاً. لأنني قرأت بعض المقالات التي كانت مشابهة لهذا قبل سنوات. لم أكن أتداول كثيرا، لذلك لم أكن أهتم. لكنني كنت أبحث عن العديد من الطرق لكسب المال وزيادة فرصي. ثم أصبحت عميل لـ Olymp Trade ووجدت هذا المؤشر، أعتقد أنني قد أعطي هذا المؤشر فرصة. لم أتمكن من تحقيق أي أرباح في البداية، لكنني حاولت ذلك لعدة أشهر. وأخيرا كنت قادرا على القيام ببعض الصفقات الجيدة التي أعطتني ربح كبير. الآن لدي فرص أفضل.

بصراحة، أنا لا أثق في المؤشرات. ولكن إذا حكمنا من خلال وصفه، يمكن أن يكون هذا المؤشر أداة فعالة. ربما سأختبره على حساب تجريبي.

سيتفق كل شخص يستخدِم تطبيق Olymp Trade على أن استخدام مؤشراتها وإستراتيجياتها أمرٌ بسيط للغاية، ويبدو أنه أكثر تطورًا. فإعدادها يستغرق أقل وقت.

مؤشر ديماركر أحد أدواتي المفضلة. لقد أوضحت هذه المقالة مدى سهولة استخدامه.

لأكون صادقًا، لا يوجد هذا المؤشر غالبًا في ترسانة أي شركة وساطة. وكقاعدة عامة، لا يعلم عن هذا المؤشر سوى بعض المتداولين. ولكن هذا لا يعني أنه بلا فعالية؛ إذ يمكنك بفضله أن تحقق دخلاً جيدًا. على سبيل المثال، يمكن استخدامه لتقليل عدد الإشارات الخاطئة من المؤشرات الأخرى.

وإنه لأمر رائع أن تضم منصة Olymp Trade مثل هذا المؤشر النادر.

أعتقد أنه بعد الانتهاء من قراءة هذه المقالة، سيرغب بعض عملاء شركة الوساطة في تجربته في التداول.

مؤشر مثير للاهتمام، وخاصة للتداول على المدى الطويل و المتوسط. أعتقد أنني بحاجة إلى دراسة المزيد لمعرفة إشارات دخول السوق.